Oil prices have rallied by around $11 per barrel Brent since the start of July.

With some private analysts predicting prices to return to levels around $100 by the end of the year, the conditions for a continued increase seem to exist.

Oil bulls, however, should tread carefully.

Structural economic problems in China – as well as financial risks in the US and stagnant to recessionary economies in the EU – put further demand growth in doubt.

With technical indicators pointing to a potentially exhausted bull market, three-digit prices may not be in the cards.

A more likely scenario might be for prices to consolidate in the $80 – 90 range – as projected by the Oxford Institute for Energy Studies.

Tight Markets Support a Price Rally

The International Energy Agency reports that global oil demand has reached the record level of 103 million barrels per day (mb/d) in July.

This puts average demand for 2023 well on its way to reach the predicted 102.2 mb/d – itself a historically unprecedented level.

Demand increases at a time when OPEC+ countries already reduced their production by 1.23 mb/d compared to June.

The main factors in that are a Saudi extension of a unilateral production cut of 1 mb/d by one further month and an equally voluntary cut from Russia by 300,000 b/d.

In addition to that, Nigeria reports a production drop to 1.29 mb/d – below even its OPEC+ quota for 2024 (1.38 mb/d).

(That decline, however, does not reflect a planned-out strategy, but results from endemic problems in the Nigerian oil sector.)

Overall, these reductions at a time of growing demand put significant upward pressure on global oil prices.

That concerns primarily the heavy and high-sulfur crudes produced by Saudi-Arabia, which are currently selling at a premium to the lighter, less sulfur-rich Brent – an extremely rare constellation.

The current market situation also pushed the price for the Russian benchmark oil Urals over the $60 price cap enacted by the EU, Australia and the G7.

Urals has similar properties to Saudi crude types and is therefore likely to exhibit similar behavior.

The price increase makes all of Russian oil exports ineligible for financing and services from the price-cap countries.

But it also provides a boost to Russian government income from the energy sector.

According to the IEA, this income stood at $15.3 bn in July, which is $2.5bn more than in June (but still $4.1 bn less than in July 2022.)

But while the rally undermines the Western price cap on Russian oil, fundamental economic factors might put a cap on the rally itself.

Economic Factors Weigh on Price Expectations

Recent data on the fundamental development of key oil consuming economies puts considerable amounts of water into the otherwise bullish wine.

Most important are signs of slowing oil demand in China, which on its own accounts for 70% of this year’s demand growth.

A „disappointing“ second quarter economic growth of merely 6.3% – from a comparatively low post-Covid level – is likely to moderate further demand growth.

Chinese trade develops equally lackluster, with exports in July down by 14.5% since July 2022, imports down by 12.3% and weak projections until the end of 2024.

Add to that structural problems like the severe and probably growing youth unemployment and the extremely high levels of outstanding payments.

Overall, China’s economic future looks increasingly uncertain.

Recent developments also point to continued and significant financial risks in the US, which was downgraded by the rating agency Finch from AAA to AA+.

In justifying its controversial decision, the agency quoted a „steady deterioration in standards of governance over the last 20 years“, implying structural doubts in the US‘ continued financial reliability.

Finally, the EU – although not the biggest driver of global oil demand to begin with – is going to remain economically stagnant this year.

Germany, its most important economy, is even in recession, dragging down the Union’s overall growth outlook.

Altogether, these economic data do not inspire much confidence in the future expansion of global oil markets.

With the electrification of transport expected to weigh oil demand down even more, oil bulls are probably well advised to hedge their bets.

Technical Indicators Show Signs of Possible Exhaustion

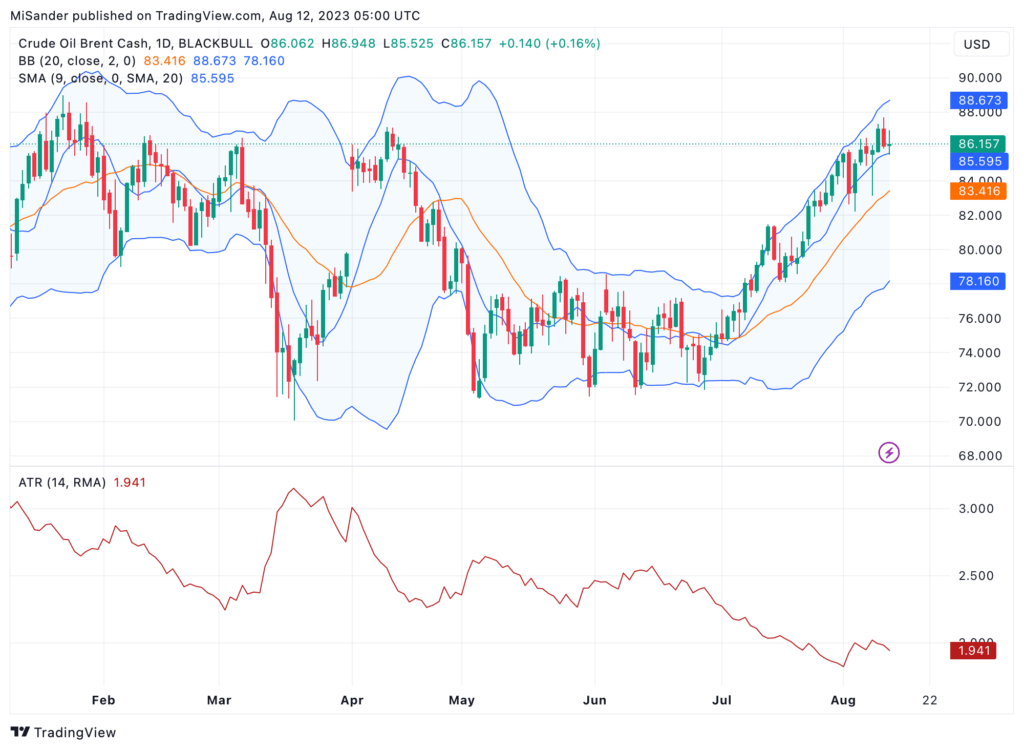

Technical indicators support this caution even further.

Since July 21, prices repeatedly closed below the 20-day simple moving average, which traders often see as a bearish signal.

Prices sometimes also closed above their upper Bollinger Band, indicating an overbought market.

Both indicators point to a possible change in the currently bullish trend.

Until now, however, smaller corrections back down to the level of the moving average sufficed to take care of any possible exhaustion.

Similarly, closing prices below the moving average did not yet lead to a fundamental trend reversal.

Nevertheless, technical indicators and market data both point towards caution regarding bullish expectations.

It bears pointing out that, until now, closing prices remained (just) below the medium-term resistance at $87.14, which was established on April, 17.

(Intraday trading exceeded that level twice.)

A closing price breaching this resistance would support a revived and sustained bullish trend.

If prices should also breach this year’s maximum of $88.9, established in early January, a further rally towards three-digit levels becomes possible.

Currently, however, a consolidation between $80 and 90 – as predicted by the Oxford Institute for Energy Studies – seems a more probable development.